Senate's Joint Committee to Decide Fate of Dopoh’s Proposed Law to Establish Liberian Institute of Tax Practitioners

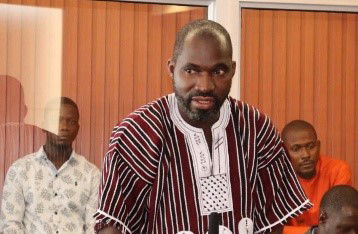

The Liberian Senate has instructed its Committees on Ways, Means, Finance and Budget, along with Judiciary, Claims, Petitions and Human Rights, to review a proposed law seeking the establishment of the Liberian Institute of Tax Practitioners (LITP). The move follows the submission of a communication by River Gee County Senator Francis S. Dopoh, who is pushing for the creation of a statutory professional body to regulate and standardize tax practice in Liberia. During Tuesday’s session, the Senate Plenary mandated Ways, Means Committee Chair Senator Prince K. Moye of Bong County to lead the joint review process.

The Judiciary Committee, chaired by Sinoe County Senator Augustine Chea, will serve as co-chair in the examination of the bill. The committees have been given one week to thoroughly scrutinize the proposed legislation and report back with recommendations. The decision came after the bill was read for the second time, prompting requests from several senators for it to be forwarded to relevant committees due to its technical and financial nature. Montserrado County Senator Saah Joseph made the formal motion calling for the bill to be turned over to the Committees on Ways, Means, Finance and Budget as well as the Judiciary Committee for deeper analysis, a motion which was immediately seconded by multiple senators.

In his communication to plenary, Senator Dopoh explained that the amendment to the Public Authorities Law is aimed at improving Liberia’s tax administration by establishing a credible, professional, and autonomous body responsible for certifying and regulating tax practitioners. He argued that Liberia’s current tax landscape suffers from weak compliance, fragmented professional practice, and the absence of a regulatory framework that ensures competency and ethical conduct among tax advisers. “Liberia continues to face significant challenges in tax administration due to the absence of a professional and regulated body of tax practitioners,” Senator Dopoh wrote.

“The establishment of the LITP will ensure competence, ethical grounding, and technical expertise among practitioners while strengthening voluntary compliance and revenue integrity.” If enacted, the Liberian Institute of Tax Practitioners would become the nation’s central authority on professional tax practice—responsible for training, administering examinations, certifying professionals, maintaining a national register of practitioners, enforcing standards, and promoting research in tax policy. The proposed law additionally seeks to transfer certain certification functions currently held by the Liberia Revenue Authority (LRA), freeing the LRA to focus exclusively on revenue enforcement and administration.

The draft act outlines a governing structure consisting of a General Assembly, Governing Council, and an Executive Director who will oversee the Institute’s operations. The Council, comprising seven elected members including a president and vice president, will be responsible for policymaking, financial oversight, staff appointments, disciplinary actions, and the publication of annual reports and audits. Senator Dopoh emphasized that creating the LITP aligns with Liberia’s broader efforts to strengthen domestic revenue mobilization a key priority under ongoing economic reform measures supported by global financial partners such as the IMF and World Bank. Following nearly unanimous approval by voice vote, the Senate Plenary directed its Secretariat to prepare copies of the bill for distribution to the reviewing committees.

The committees are expected to return with their findings and recommendations upon the Senate’s return from its brief adjustment period. The proposal is regarded as a significant step toward modernizing Liberia’s fiscal governance framework. Policy analysts and business leaders argue that if passed, the LITP could help close long-standing gaps in Liberia’s revenue system, enhance compliance, improve transparency, and elevate the standards of tax administration nationwide. The Senate is expected to revisit the matter next week when the joint committee presents its report, which will determine whether the bill advances to further legislative action or requires revision.

Author: Zac T. Sherman